Small and medium-sized enterprises (SMEs) are the backbone of the Luxembourg economy. They create jobs, innovation and growth. In the wake of the pandemic and the various economic shocks, however, their activities are being affected. In a joint publication, the Luxembourg Chamber of Commerce and the Union des Entreprises Luxembourgeoises (UEL) set out a number of actions to strengthen the economic fabric of SMEs. A series of targeted tax measures should ensure sustainable growth and diversification of the Luxembourg economy.

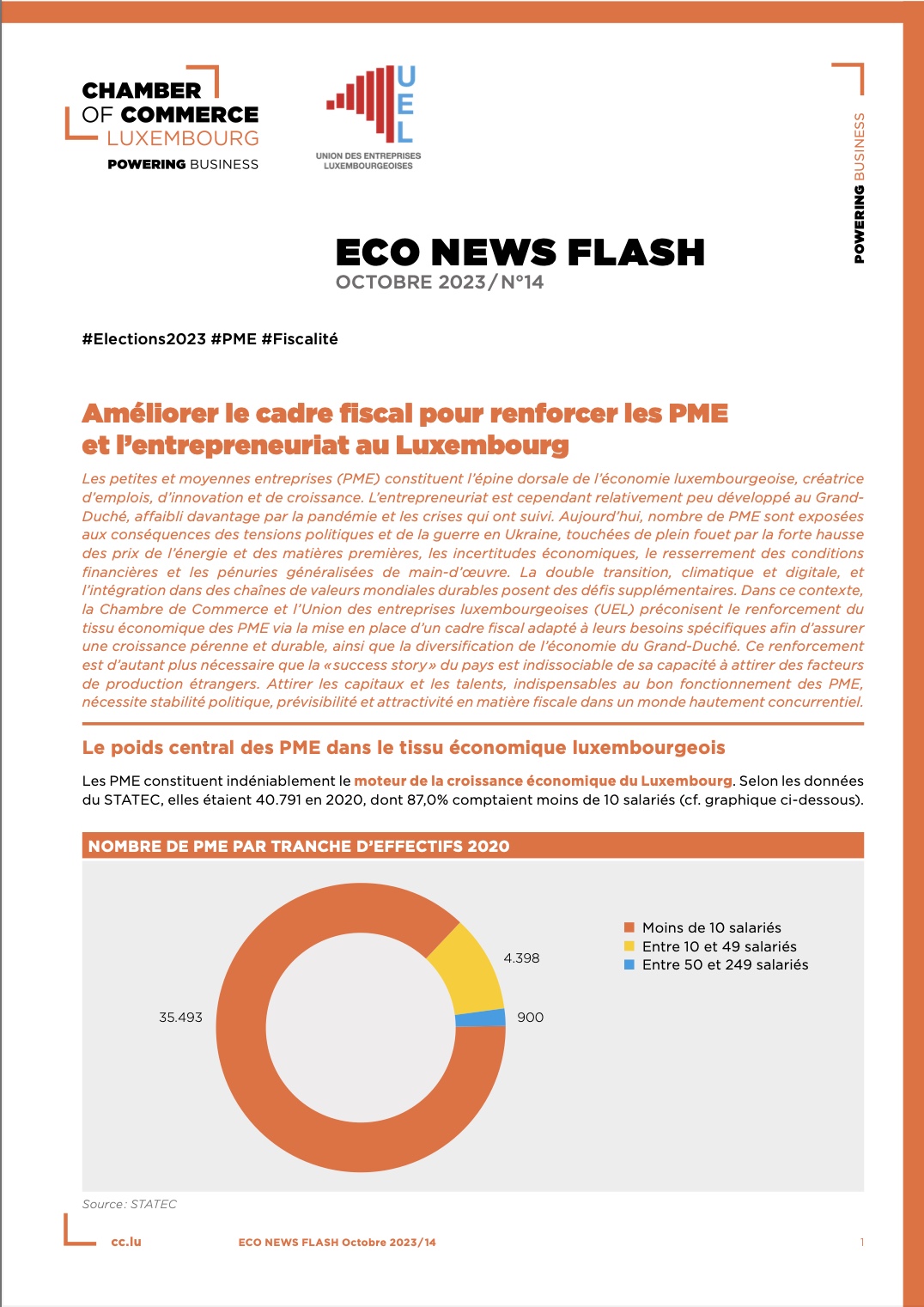

Luxembourg’s 37,900 SMEs make up 99.5% of the country’s non-financial business economy, employing 202,210 people (59.2% of total employment in industry, construction, trade and services). In recent years, they have experienced difficult times as a result of successive crises, from Covid to material shortages, rising inflation and energy crises. In 2022 and 2023, they have been subject to five index-linked salary increases, raising labor costs without necessarily being able to pass them on in their prices. Their profitability has been severely tested. Generating margins is a sine qua non for making strategic investments, modernising infrastructures, developing new products and services in line with customer expectations, and generally keeping up with the environmental and digital transition.

At the same time, the entrepreneurial spirit has lost ground since the pandemic. In 2022, Luxembourg ranked 39th (out of 49 countries) for the proportion of adults starting or running a new business, with a rate of 7%, according to the international ranking of the Global Entrepreneurship Monitor. Fear of failure, lack of access to financing and administrative complexity explain, in part, the reluctance to initiate or maintain a self-employed activity. What’s more, self-employed status is unattractive and even precarious.

The need to support entrepreneurship is clear. To move forward, taxation is a major lever for action. In a new joint publication in the “Eco News Flash” series, the Chamber of Commerce and the UEL have put together some twenty concrete tax measures to inject new momentum on the eve of parliamentary elections and the formation of the next government coalition.

“Through tax levers, we can act in a targeted and effective way to meet the pressing needs of SMEs, particularly in terms of the attractiveness of a skilled workforce and the ability to adapt to technological change. We need tools that will enable us to boost the competitiveness of the economy”, notes Carlo Thelen, General Manager of the Chamber of Commerce.

“Taxation must be at the heart of the new legislature. We need to send a strong signal to every economic player, including SMEs, by implementing targeted tax measures. Let’s not forget that SMEs are the backbone of the country’s innovation ecosystem, at the service of a prosperous and sustainable Luxembourg economy”, also emphasises Jean-Paul Olinger, Director of UEL.

The joint publication focuses on proposals to support the self-employed, to help companies in their search for skilled labor, in their development and success in the dual environmental and digital transition, and in preparing for the transfer of the business.