Employers, do you have cross-border teleworking employees and are you wondering about the tax consequences for your employees and for your company?

We invite you to consult our brochure which summarises the different tax rules applicable to your cross-border teleworking employees (including in the context of the Covid-19 health crisis) as well as the tax consequences that may result for you as an employer.

This brochure aims to help you to better understand the possible tax obligations for you by answering the most frequently asked questions such as

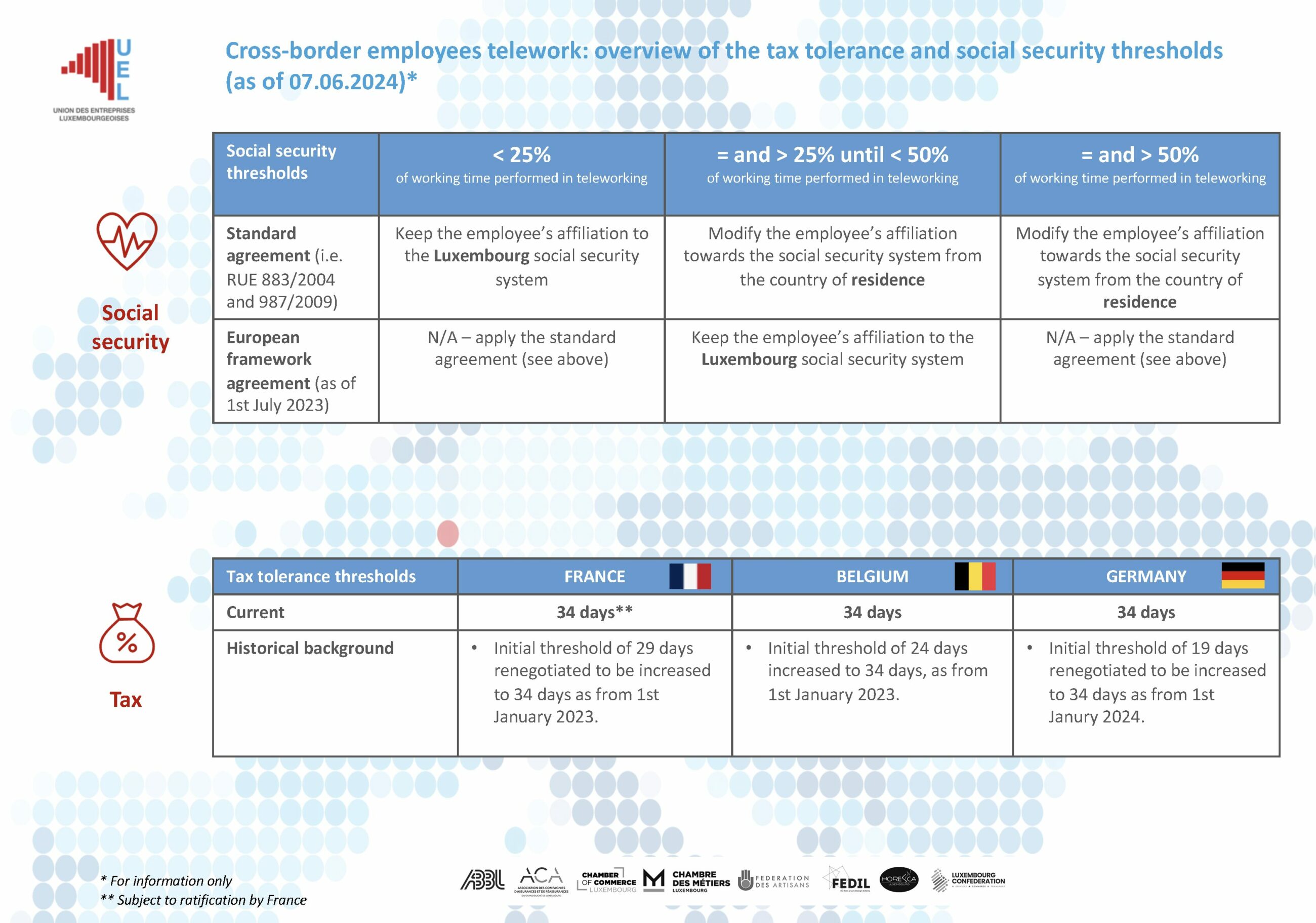

- What are the tolerance thresholds applicable with each border country?

- What are the specificities of the Covid period and how to apply the tolerance thresholds for 2022?

- In which cases is there a risk of recognition of a permanent establishment for your company?

- What are the supporting documents to be kept by employers?