The economy to rebuild the “Golden Triangle”

09.02.2024

UEL positions and opinions

Nicolas Simons, Chief Economist

A strong economy based on prosperous businesses provides high wages and the budget revenues a country needs to finance its social ambitions, while ensuring a certain balance in public finances.

Luxembourg has traditionally succeeded in creating a supportive economic environment, one in which companies have been able to grow and create value. In economic terms, growth in real GDP – i.e. gross value added in volume terms – has always been relatively stronger than in the rest of Europe. The dynamism of Luxembourg companies has enabled employees and civil servants to enjoy the highest level of remuneration and the most generous social system of any country in the European Union, all while maintaining – relatively – healthy public finances.

In recent years, decision-makers have tended to forget the balancing principle of this Golden Triangle, hindering economic development and pushing ever further ahead with the social system. With the Golden Triangle principle gradually breaking down, the UEL has consistently warned of the urgent need to act on the economic pillar if Luxembourg is to maintain its high social standards without undermining its financial independence.

The figures for 2023, due in particular to the maintenance of the indexation system in a period of high inflation, confirm that the balance has been broken:

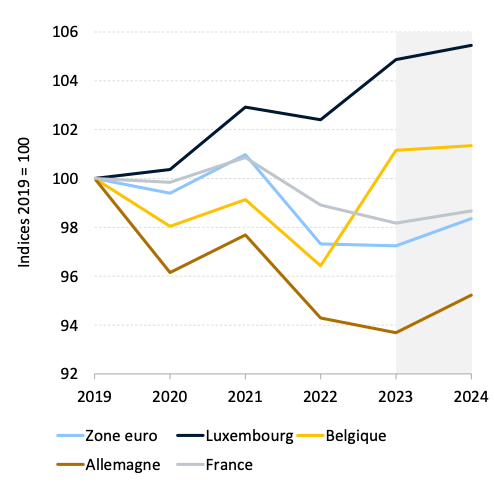

For the year 2023, the Luxembourg economy is in recession, with a real GDP decline of -1.1%! All economic sectors are affected, although the financial and construction sectors are the hardest hit. UEL notes that Luxembourg’s economic growth over the years 2022-2023-2024 will be sluggish, and even lower than that of the European Union.

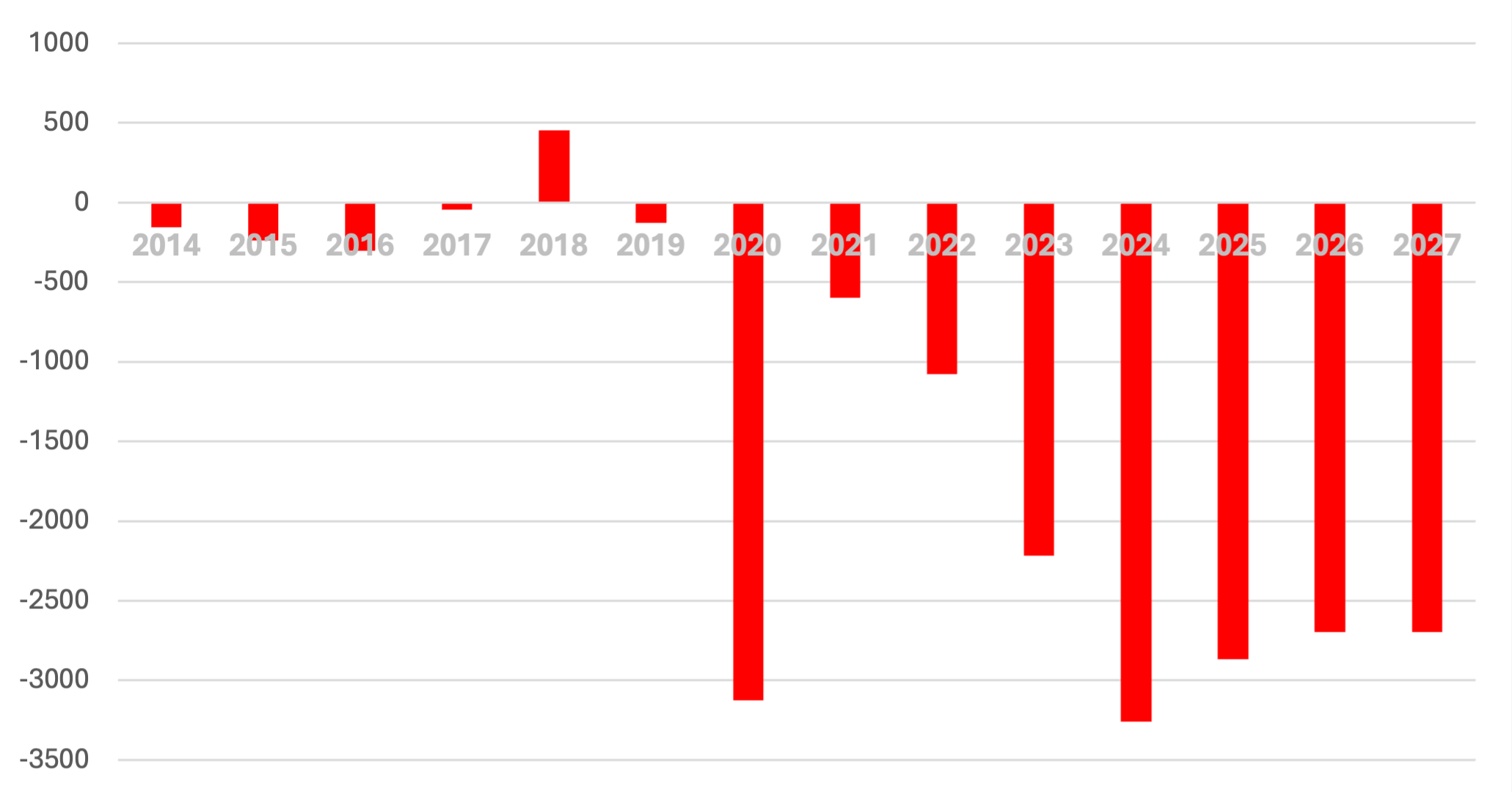

Public finances are in the red, with a (forecast) central government deficit in 2023 of EUR 2.2 bn, the highest deficit since 2020, when the economy came to a standstill.

As summarized by the National Productivity Council in its latest Report, “weak economic growth and the budgetary impact of measures, particularly those under the tripartite agreement, are fuelling the public deficit“.

UEL notes that the slippage is becoming structural, since the IGF anticipated, during its exchanges with the Formateur and as shown in the graph below, a cumulative deficit of EUR 10 bn over the period 2023-2027.

And in this difficult situation on the economic and public finance pillars, gross wages, real wages and savings are increasing in Luxembourg. UEL notes that, after several years of crisis, real wages (i.e. after taking inflation into account) are now 6% higher than in 2019. This situation contrasts with other European countries.

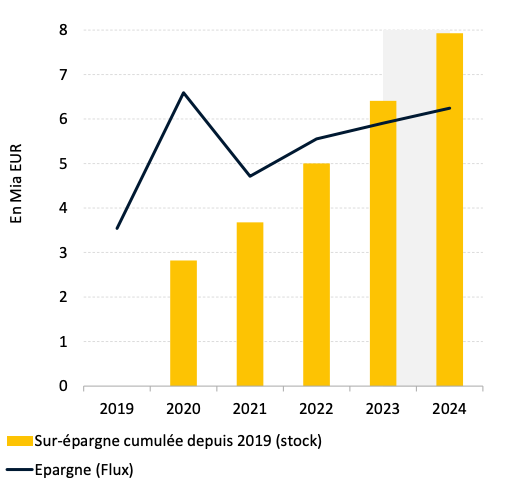

The UEL takes this opportunity to point out the perverse and anti-social effect of the current indexation system. For example, the 5 indexations received by employees since October 2021 represent a salary surplus of EUR 16,000 a year for someone earning EUR 10,000 a month, whereas someone earning the minimum wage only received an annual surplus of EUR 4,000.

For the latter, the entire surplus has been consumed. For the former, the surplus is so large that he was unable to consume it all, and so saw his savings accumulate.

In Luxembourg, real wages and savings continue to rise

UEL’s objective is not to reduce the welfare state (although a certain amount of selectivity is required to give priority to those who need it), but to act to revive the economy and the dynamism of businesses, for it is they, and only they, that generate income and budgetary contributions offering such a high quality of life.

Like all businesses, UEL is optimistic and forward-looking. On reading the coalition agreement, we dare to believe that the current government has understood the scale of the challenge.

Our shared ambition is to put the country back on a path of economic growth and thus rebuild the Golden Triangle.

This article was written by Nicolas Simons, Chief Economist at UEL.

Our members